LESCO Taxes and Duties

The government collects taxes from its people to perform its functions. Some taxes are direct and some are called indirect taxes. Direct taxes are collected directly from persons in the form of income tax, property tax and capital gain tax.

Whereas indirect taxes are collected indirectly in the form of sales tax, excise duty, customs duty and service tax. The taxes are collected indirectly from persons. Mostly these are collected from bills and other means of tax collection. The burden of indirect taxes falls upon end users.

In bills, there are many taxes included like electricity duty, sales tax, federal levy, income tax, FC surcharge, PTV fee, fuel price adjustment, extra tax, further tax and sale tax.

In this article, we will discuss all these taxes in detail and their impact on electricity prices. In the end, we will give you some advice to get relief from these taxes and to decrease your electricity bill.

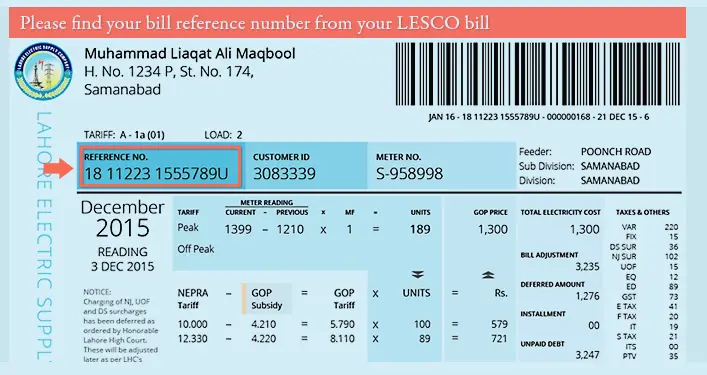

You can check your bill online by visiting Duplicate Bill Check

Electricity Duty

It is a provincial duty and levied on all consumers ranging from 1% to 1.5% of variable charges. It means when our consumption increases the amount of electricity duty also increases. It is directly proportional to our electricity consumption.

General Sales Tax

It is levied under the section of the Sale Tax Act of 1990 at the rate of 17% on all the consumers at the entire bill. It is a complex tax, it is applied to the final amount of the bill which includes all the taxes already. It is a progressive tax, it increases with the increase in the bill.

PTV Licence Fee

It is charged at a fixed rate from consumers. From domestic users, it is charged Rs. 35/ and from commercial users Rs. 60/ in the electricity bills. As it is a fixed tax it does not change with the increase in consumption.

Financing Cost Surcharge

Simply it is called FC Surcharge and it is charged at the rate of Rs 0.43 per kWh ( Per Unit ) to all categories of consumers, except lifeline domestic consumers. It is also a progressive tax as its amount increases as we consume more units.

Fuel Price Adjustment ( FPA )

It is a difference between actual fuel prices and reference fuel prices. In simple words, we can explain it as, the proposed price of fuel for the current month and the actual price for the current month. As most electricity is produced by thermal means and they use fuel for this purpose, furnace oil prices change diversely.

If furnace oil prices increase from the proposed prices then FPA is added to the bill. But, if the actual prices decrease than the proposed price the FPA is deducted from the consumer’s bill. It is, mostly adjusted after 3 months.

Consumers suffer most from FPA because it is charged at previously used units and the bill becomes unbearable due to positive FPA.

Extra Tax

It is being charged to the industrial and commercial users who are not registered in the Active Tax Payer List ( ATL ) of FBR at the rate of 5% to 17% on different bill amount slabs.

Further Tax

It is levied on all consumers at the rate of 3% who do not have a Sales Tax Return Number ( STRN ). But it does not apply to domestic, agriculture, bulk consumers and street light connections.

Income Tax

It is charged at various rates to consumers depending upon applicable tariff and the amount of electricity bill. It does not apply to lifeline users and with low electricity bills.

Sales Tax

It applies to commercial consumers only and is charged at the rate of 5% up to bills of Rs. 20000 and 7.5% who exceed the limit of Rs. 20000.

These taxes are being charged to consumers and the amount of bills increases significantly due to these taxes. In most cases, taxes increase from the actual amount of electricity.

You can verify all this information from the official website of the Ministry of Energy Power Division.

How to Minimise the LESCO Taxes and Duties

Electricity bills, no doubt are a big burden on poor persons and consume a larger portion of their income. Here we will discuss some methods to minimise the use of electricity and it will lead to a decrease in the electricity bill.

You can calculate your bill easily, for this purpose visit Bill Calculator

Stay in Protected Consumers

Govt give a subsidy to protected consumers and charges a very low unit price. If we consume less than 200 units for 6 months, we will be in this category. Here our bill will be low and we will not face any price hike in electricity prices and other taxes.

For this, we can adopt a simple lifestyle and use energy-efficient appliances.

We should use

- Energy saver bulbs and LEDs

- Energy saver fans

- New technology-based refrigerators

- We should avoid using heavy electric appliances during peak hours

Stay in low-slab

Try to keep the consumption of electricity as low as possible. For this purpose, we should have a check and balance on our usage and will try to keep it at a lower slab. It will reduce the taxes in our bill as most of the taxes increase with higher consumption.

Solar Energy

In the present era, Solar Energy is a blessing of science. We just bear its installation charges only once and it produces energy for 10-15 years free of cost.

Moreover, its efficiency increases day by day and we get higher outputs from it. If we use it, our electricity bills will be minimised. If we can not afford large-scale production, then we can use it on a small scale and daytime only.

If we use it in the daytime only it will not cost much but it will decrease our bill significantly.

Register in FBR

We should register ourselves with the Federal Board of Revenue ( FBR ) and get our National Tax Number (NTN ). It will help us to get rid of income tax in our bill and if it comes we can claim the tax return at the end of the year.

We should be in ATL of FBR, it will eliminate the Extra Tax of 5% to 17% on commercial and industrial users.

Further, we should register our business with the FBR and should get STRN. It will eliminate Further Tax from our bills which is 3% of our electricity bill.

Conclusion

No doubt electricity prices are a burning issue in Pakistan and we all suffer from this. Electricity bills include several taxes which affect us most. But, by following some guidelines which we have discussed earlier, we can manage to minimise electricity bills. By following the instructions mentioned above we will save electricity for our nation and money for us.